You can then submit the claim for reimbursement later and still receive the tax-free benefits of an FSA. When this happens, you can still pay for that qualified expense out-of-pocket. It is possible that your card declines when making a qualified purchase. If you're worried about using your card at a merchant, you can look up to see if there are any qualified merchants in your area. Your FSA debit card only works at certain providers and merchants. If you try to use your FSA debit card to purchase eligible items and it declines, there are a few reasons why this can happen.

Depending on the inventory of FSA eligible items, some of these stores will require additional documentation. There are many different types of merchants where you can use your FSA. This is when your provider would alert you that they need more information. Sometimes, there isn't enough information from the merchant to auto-substantiate your purchase. When you pay for items at these stores, the transaction goes through with the assumption that you purchased qualified expenses.Īlgorithms review the purchase to determine if it was an eligible expense. Your medication is FSA-eligible - your snack is not. For example, you could be picking up some over-the-counter medication at a pharmacy, but grab a snack on the way out. However, not all products at these stores are FSA-eligible. The intent for your debit card is that it works at merchants and providers where most of the services and products are FSA-eligible. Why are some debit card purchases authorized, but I still need to submit a receipt? Big stores like Target, Costco, Walgreens, CVS, Amazon and the FSA Store are a few examples of retailers who are currently set up to auto-substantiate your FSA purchases. Pay as you would with your FSA debit card and you're all set.Īuto-substantiation is most commonly seen at large, national retailers and pharmacies. When an expense is auto-substantiated, you won't need to share any receipts with your FSA provider. This helps providers authorize eligible expenses without any additional documentation. When paying with your debit card, certain merchants have systems setup to identify eligible expenses. If your documents, such as an itemized receipt or explaination of benefits (EOB), cover these five elements, approving your payments will be simple.įor dependent care, the document must come from a third party and may not be a cancelled check. When submitting documents and receipts for substantiation, be sure to follow the Rule of Five. When this happens, your FSA provider will want documentation to ensure that your expense is eligible. In exchange, they want proof that you are using those funds for the expenses they deem eligible.ĭid your FSA provider request substantiation for a transaction? It's because the merchant that you purchased from was unable to substantiate the expense on their own. Think of it like this: the IRS lets you use tax-free funds to pay for medical expenses. This means that you need to prove that everything paid from your FSA is an eligible expense.

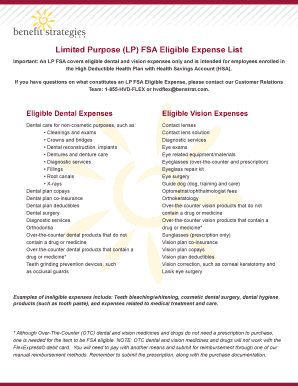

FSA ELIGIBLE EXPENSES VERIFICATION

This verification process is "substantiation". The IRS requires that every dollar spent from an FSA be eligible and verified. What is substantiation and why is it required? Here are a few tips to help you become an FSA expert. With the right information, you can navigate through these rules easily. Substantiation? Eligible expenses? FSA card declined and unsure why? While FSAs are great for helping you save money, there are rules that may be a little confusing.

0 kommentar(er)

0 kommentar(er)